It all started with the AA devaluations. I decided I wanted to burn some miles on a 1st class experience before the ‘price’ jumped by several thousand miles and sooner rather than later. Deciding on a destination was based on which first class cabin I wanted to experience. The JAL 1st class suites really piqued my interest after reading this trip report. So, using the BA website, I looked for one way availability on either the ORD, JFK or LAX to NRT routes. Amazingly, the ORD-NRT had 2 seats available April 5th which coincided perfectly with the cherry blossom season in the Tokyo area. Yay! I called AA and booked the flight on JAL using 62,500 AA miles. Incidentally, at the time I booked this trip, the ticket was showing up for over $13,000 (not that anyone would actually pay that price).

Below, I’ve listed the highlights and posted some photos of my experience. At the bottom of the trip report you’ll find my spending totals in miles and USD.

Flagship Admiral’s Club Lounge at ORD Food and drink options were excellent. I got in early enough to sample both breakfast and lunch offerings at the lounge.

Flagship Admiral’s Club Lounge at ORD Food and drink options were excellent. I got in early enough to sample both breakfast and lunch offerings at the lounge.

First class check-in and boarding experience. After walking past the long line of economy passengers I was whisked to seat 1K

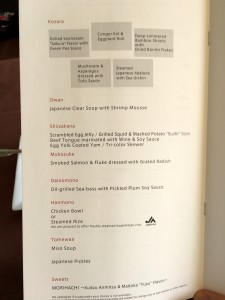

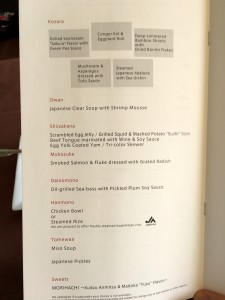

Once airborne, the flight attendant set my table with a slightly faded brown table cloth and presented me with a menu and hot towelette to wash my hands.

plumbers in north hollywood ca teeth whitening nj morristown dental dentist in long island tampa real estate attorney free consultation

The menu contained a six course meal with either Western or Japanese menu items. I chose the Western menu as I wasn’t sure how the Japanese menu items would affect my digestive experience. Most of the food was excellent, except for the garlic bread that tasted like it had sat forgotten in a lunchroom microwave for a day. I had caviar for the first time and enjoyed it.

The lie-flat bed was comfortable, with JAL issue PJ’s and Bose sound canceling headphones A personal coffee pot and the unique JAL coffee mug with the long handle that touched the table was served to me for breakfast. Arrival at Narita airport Passport control was a breeze with no wait time. Finding the Hilton shuttle at bus stop 26, not 16 as indicated on Hilton app was annoying but made less so by a helpful attendant who spoke no English but recognized the Hilton picture on my phone and pointed out the number of the bus stop.

Check in to hotel High tech toilet with spray options and music was entertaining. Complimentary bottled water. bathrobe and disposable slippers were a nice touch. There was an a-la-carte bar containing various drinks and snacks with prices listed on a sheet of paper that I didn’t make use of.

Woke up early due to jet lag. Took first shuttle at 4:45 AM to ORD, only to discover that Keisei ticket counters open at 7. Bought round trip Skyliner and 48hr subway pass deal from Keisei Electric Railroad for $46.

Woke up early due to jet lag. Took first shuttle at 4:45 AM to ORD, only to discover that Keisei ticket counters open at 7. Bought round trip Skyliner and 48hr subway pass deal from Keisei Electric Railroad for $46.

Tsukiji Fish Market – I arrived in Tokyo in the pouring rain, bought an umbrella, and immediately took the subway over to the fish market. On the way, I stepped around a fight breaking out between two men on the subway platform. Police took five seconds to respond and break it up. It was the weirdest fight. No shouting. Just grunting pushing and grappling without any exchange of words. Walked to fish market from closest subway station and successfully dodged all the small truck/carts that were racing every which way.

Tsukiji Fish Market – I arrived in Tokyo in the pouring rain, bought an umbrella, and immediately took the subway over to the fish market. On the way, I stepped around a fight breaking out between two men on the subway platform. Police took five seconds to respond and break it up. It was the weirdest fight. No shouting. Just grunting pushing and grappling without any exchange of words. Walked to fish market from closest subway station and successfully dodged all the small truck/carts that were racing every which way.

Got my fill of fish smells and dead fish viewing and moved on fairly soon.

Imperial Palace – this place was very quiet with a few brave tourists hanging out in the pouring rain and looking at the ancient buildings.

Aoyama Cemetery. The combination of rain, cherry blossoms and very ornate tombstone arrangements was tranquil and inexplicably enjoyable.

Aoyama Cemetery. The combination of rain, cherry blossoms and very ornate tombstone arrangements was tranquil and inexplicably enjoyable.

Shibuya Crossing was next. I bought a sandwich at Starbucks, headed to the second floor viewing area and took a time lapse video of the Shibuya Scramble on my iPhone.

I then explored the Shibuya shopping district and ate some amazing sushi at a stand up sushi bar I found right next to Burger King.

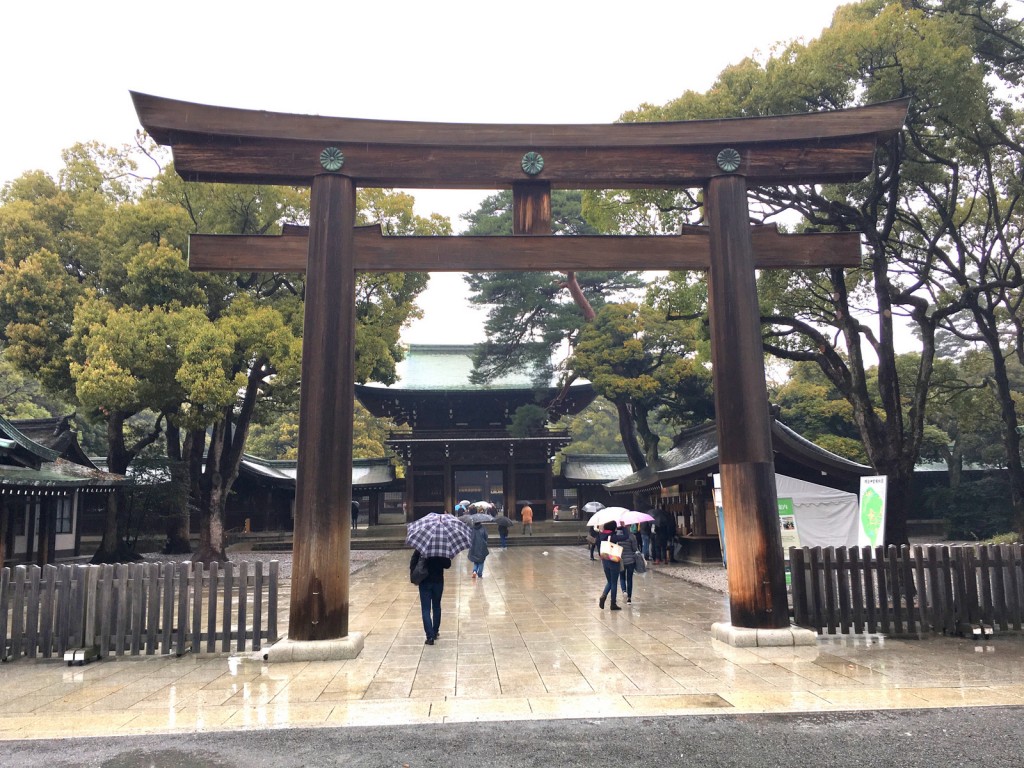

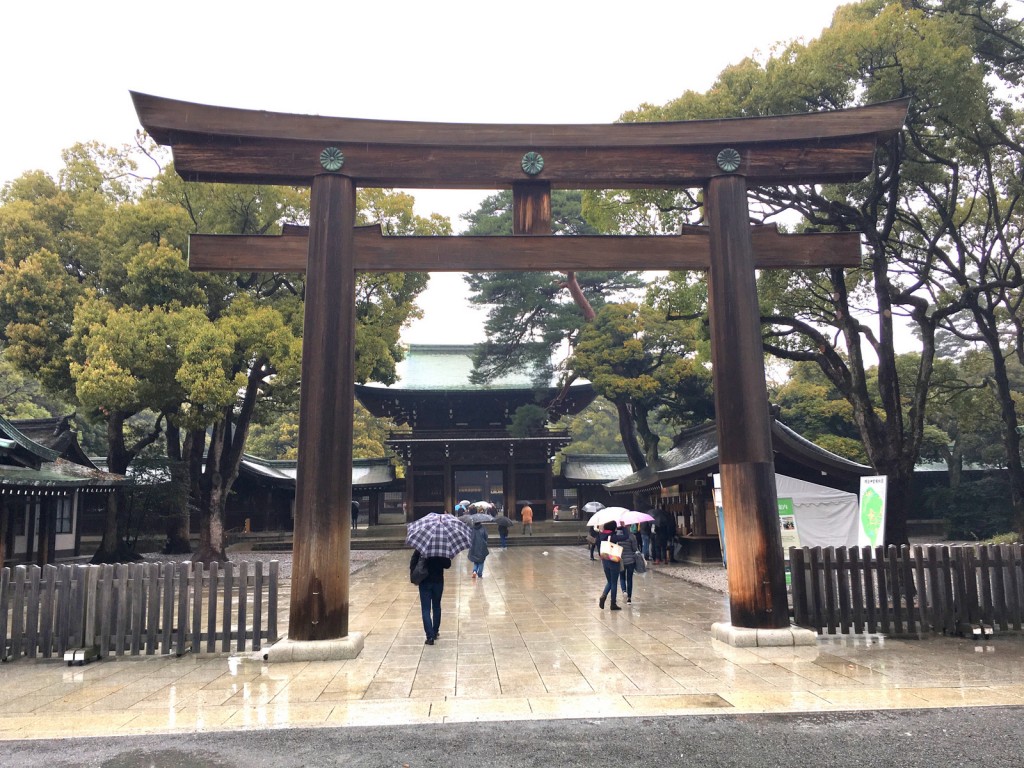

Meiji Jinju shrine – I walked around for an hour or so. The actual shrine is way back from the main road and is a bit of a hike to get to.

Metropolitan Government Building – This building had fairly decent, if not crowded, daylight views of the city.

But I was after something more. So I quickly headed over to another spot I’d heard of that had an even better view.

World Trade Center – I was able to time my arrival at the World Trade Center’s 40th floor observation deck right at dusk as the rain clouds were being swept away, revealing all the city lights and the Tokyo Tower lit brilliantly. I took many photos and just relaxed in a chair with me feet propped up on the window sill for awhile.

Capsule Hotel – Exhausted, with fairly sore feet from so much walking, I made my way to the capsule hotel I had booked for $21 USD and fit my six foot frame diagonally in the capsule for a good night’s sleep. Yes, the capsules are small, but I had earplugs and a sleep aid and slept just fine.

Capsule Hotel – Exhausted, with fairly sore feet from so much walking, I made my way to the capsule hotel I had booked for $21 USD and fit my six foot frame diagonally in the capsule for a good night’s sleep. Yes, the capsules are small, but I had earplugs and a sleep aid and slept just fine.

Asakusa Shrine – Early morning, found me headed over to the Asakusa Shrine. I wandered around, just people-watching for awhile. Many people on their way to work would stop briefly to pray at the various statues.

Asakusa Shrine – Early morning, found me headed over to the Asakusa Shrine. I wandered around, just people-watching for awhile. Many people on their way to work would stop briefly to pray at the various statues.

Shinjuku Gyoen Park – This place was on my wish list to do some more people watching and relax amid the cherry blossoms. Upon entry, all bags were being sniffed by security personnel for presence of alcohol which is prohibited in the park (I’m not kidding!). Apparently Japanese people like to drink rice wine and look at cherry blossoms. Who knew? The guard didn’t even bother sniffing my bag or the Australian ahead of me in line as we weren’t the ‘target market’.

Shinjuku Gyoen Park – This place was on my wish list to do some more people watching and relax amid the cherry blossoms. Upon entry, all bags were being sniffed by security personnel for presence of alcohol which is prohibited in the park (I’m not kidding!). Apparently Japanese people like to drink rice wine and look at cherry blossoms. Who knew? The guard didn’t even bother sniffing my bag or the Australian ahead of me in line as we weren’t the ‘target market’.

Takeshita-guchi Street Shopping Area – What a name, right?! This was a fun side excursion as I started wending my way back to the airport. Ueno Park Shopping Area – I realized I hadn’t picked up any souvenirs yet, so I stopped by the ‘Japan Shop’ just outside the Ueno train station.

Takeshita-guchi Street Shopping Area – What a name, right?! This was a fun side excursion as I started wending my way back to the airport. Ueno Park Shopping Area – I realized I hadn’t picked up any souvenirs yet, so I stopped by the ‘Japan Shop’ just outside the Ueno train station.

Back to NRT via return Skyliner Express ticket. Something new for me was airport security providing slippers to go through the metal detector as I had of course removed my shoes. At the departure gate, a drum band dressed in traditional garb, played for about 45 seconds and then provided a photo op for waiting passengers at the gate.

Stopover in LA – I had a stopover in LA, where I rented a car and drove around for a few hours. It was my first time in LA, so I went up to the Griffith Observatory, drove through Hollywood on Sunset Blvd and checked out some back roads in the Beverly Hills including Mulholland Drive. Then I finished up with a walk on the Santa Monica Beach before heading back to the airport to continue on my journey home.

Stopover in LA – I had a stopover in LA, where I rented a car and drove around for a few hours. It was my first time in LA, so I went up to the Griffith Observatory, drove through Hollywood on Sunset Blvd and checked out some back roads in the Beverly Hills including Mulholland Drive. Then I finished up with a walk on the Santa Monica Beach before heading back to the airport to continue on my journey home.

Points & Miles Spent:

Points & Miles Spent:

- ORD-NRT 1st Class on JAL – 62,500 AA miles

- NRT-LAX-DFW economy on AA metal – 25,000 AA miles

- Hilton Narita – 20,000 HHONORS points

USD Spent:

- Food/Drinks: $65 I ate sushi and trail mix mostly. Drinks from vending machines.

- Capsule Hotel: $21

- Skyliner Express and Subway Tickets: $46

- Souvenirs: ~$50

- PHL-ORD flight $40

- DFW-PHL flight $53

- Car rental at LAX to drive around and sight-see (first time in LA) $56

- Under 21 days out AA booking fees $75*2 = $150

- AA booking airport taxes $5.60*2 = $11.20

TOTAL USD: $492.20 for 5 days of travel

I could have saved in several areas (I splurged on the Narita Express train and a full size car at LAX), but $100/day all in, for a 5 day trip to Japan and LA is still a great deal in my experience. I also could have saved $150 on the AA booking, but was looking to sample the first class experience and last minute travel holds a certain thrill for me anyway. Three things made this trip enjoyable and a memorable experience:

- Planning every detail of travel as well as building in some flexibility in the itinerary.

- Traveling with only a 12 lb backpack.

- Downloading Tokyo specific apps on my iPhone with full offline capabilities.

Tokyo is an incredible city and I will definitely be back. The efficiency of the subway beats anything I’ve seen (and I’ve been to 20+ major global cities like NYC, Vancouver, Amsterdam, DC, etc). I hope this trip report inspires someone else to go out and explore our world helped by miles and points. 🙂

Addendum:

Here’s my complete packing list for this trip:

Travel Documents / Currency

- Passport

- Driver’s License

- Printed copy of passport and license

- Printed copy of trip itinerary

- Wallet w/credit & debit cards (w/travel notification done on each)

- Primary: CapitalOne QuickSilver, Capital One 360 Debit for free ATM withdrawals. You can get $20 if you sign up for a Capital One 360 checking account through this link. It’s my number one card for when I’m traveling and want to pull local currency out of an ATM with no fees.

- Secondary/Backup: Capital One Venture, Fidelity Cash Management Debit

- Health insurance cards

- Cash

- Small paper pad and pens

Food/Snacks

- Trail Mix

- Energy bars

- Dried fruit/veggies

Personal & Health

- Toothpaste and toothbrush

- Contact lenses, accessories and glasses

- Pain killer

- Laxatives

- Sleep Aid

- Allergy Pills (non-drowsy and drowsy)

- Inflatable neck pillow, face mask and earplugs

- Deodorant

Clothing (in addition to what I’m wearing)

- 3 pairs of underpants

- 3 pair of socks

- 3 good t-shirts

- 1 sweater

Electronics/Media

- iPhone w/charger and apps for off-line travel use

- Apple Earpods with mic/remote for entertainment and calls over WiFi

- Anker Portable battery pack for charging iPhone when away from power source

- Sony a6000 camera & accessories kit

- Several 64 GB SD cards

How did these two perform against each other? If I had to pick just one, I’d choose the infrared heater. I found the infrared heater was better at heating a larger space than the oil filled radiant heater. Why? Because, the infrared heater has a fan that pushes the hot air away from the infrared heating elements and circulates this heated air throughout the room, whereas the radiator simply uses the process of convection to heat the air and objects around it (a much slower process). What I ended up doing was to use eaach heater for different tasks. I placed the infrared heater centrally in my home to supplement my central heating system and used the oil-filled radiant heater to heat just one room (office or bedroom) which it did quite well. I never tested either unit, but I have a feeling the oil filled radiator actually uses less power than the infrared unit due to the fact that the infrared unit is always on (if set to maximum temperature) and the oil unit cycles off as the oil reaches a high enough temperature and subsequently cools down during the convection process.

How did these two perform against each other? If I had to pick just one, I’d choose the infrared heater. I found the infrared heater was better at heating a larger space than the oil filled radiant heater. Why? Because, the infrared heater has a fan that pushes the hot air away from the infrared heating elements and circulates this heated air throughout the room, whereas the radiator simply uses the process of convection to heat the air and objects around it (a much slower process). What I ended up doing was to use eaach heater for different tasks. I placed the infrared heater centrally in my home to supplement my central heating system and used the oil-filled radiant heater to heat just one room (office or bedroom) which it did quite well. I never tested either unit, but I have a feeling the oil filled radiator actually uses less power than the infrared unit due to the fact that the infrared unit is always on (if set to maximum temperature) and the oil unit cycles off as the oil reaches a high enough temperature and subsequently cools down during the convection process.

Flagship Admiral’s Club Lounge at ORD Food and drink options were excellent. I got in early enough to sample both breakfast and lunch offerings at the lounge.

Flagship Admiral’s Club Lounge at ORD Food and drink options were excellent. I got in early enough to sample both breakfast and lunch offerings at the lounge.

Woke up early due to jet lag. Took first shuttle at 4:45 AM to ORD, only to discover that Keisei ticket counters open at 7. Bought round trip Skyliner and 48hr subway pass deal from

Woke up early due to jet lag. Took first shuttle at 4:45 AM to ORD, only to discover that Keisei ticket counters open at 7. Bought round trip Skyliner and 48hr subway pass deal from

Takeshita-guchi Street Shopping Area – What a name, right?! This was a fun side excursion as I started wending my way back to the airport. Ueno Park Shopping Area – I realized I hadn’t picked up any souvenirs yet, so I stopped by the ‘Japan Shop’ just outside the Ueno train station.

Takeshita-guchi Street Shopping Area – What a name, right?! This was a fun side excursion as I started wending my way back to the airport. Ueno Park Shopping Area – I realized I hadn’t picked up any souvenirs yet, so I stopped by the ‘Japan Shop’ just outside the Ueno train station.

Stopover in LA – I had a stopover in LA, where I rented a car and drove around for a few hours. It was my first time in LA, so I went up to the Griffith Observatory, drove through Hollywood on Sunset Blvd and checked out some back roads in the Beverly Hills including Mulholland Drive. Then I finished up with a walk on the Santa Monica Beach before heading back to the airport to continue on my journey home.

Stopover in LA – I had a stopover in LA, where I rented a car and drove around for a few hours. It was my first time in LA, so I went up to the Griffith Observatory, drove through Hollywood on Sunset Blvd and checked out some back roads in the Beverly Hills including Mulholland Drive. Then I finished up with a walk on the Santa Monica Beach before heading back to the airport to continue on my journey home. Points & Miles Spent:

Points & Miles Spent:

Roofs will all eventually wear out and need replacement. The question is, how do you know if your roof just needs a quick roof repair job or whether it needs to be completely replaced? If you replace your roof to soon, you might just be throwing money away. Alternatively, if your roof is in terrible condition and has multiple leaks over a wide area, you may end up spending more money in the long run due to water damage in your home’s interior. To know which decision is right for you, let’s look at a few key factors in deciding to repair or replace a roof.

Roofs will all eventually wear out and need replacement. The question is, how do you know if your roof just needs a quick roof repair job or whether it needs to be completely replaced? If you replace your roof to soon, you might just be throwing money away. Alternatively, if your roof is in terrible condition and has multiple leaks over a wide area, you may end up spending more money in the long run due to water damage in your home’s interior. To know which decision is right for you, let’s look at a few key factors in deciding to repair or replace a roof. Plan your meals – The first thing I advise when you are attempting to eat healthier is to plan your meals for the week. By planning out what you are going to eat you can make healthy, informed choices. You will be far less likely to splurge on a greasy hamburger and French fries if you have a healthy salad and chicken meal all ready to eat in your slow cooker at home. You can also buy all the ingredients you need for the recipes so that you do not get frustrated and give up. Planning meals also helps you to be more creative and varied with your cooking so that you do not get burned out on one meal or become nutritionally unbalanced. Meatloaf may be your favorite, but eating it three times a week will burn anyone out. By planning your meals in advance you can look up new recipes, try out new foods, and have more fun with your cooking. It is no fun to dig through a cookbook when you are tired and hungry, so save yourself the trouble and plan ahead.

Plan your meals – The first thing I advise when you are attempting to eat healthier is to plan your meals for the week. By planning out what you are going to eat you can make healthy, informed choices. You will be far less likely to splurge on a greasy hamburger and French fries if you have a healthy salad and chicken meal all ready to eat in your slow cooker at home. You can also buy all the ingredients you need for the recipes so that you do not get frustrated and give up. Planning meals also helps you to be more creative and varied with your cooking so that you do not get burned out on one meal or become nutritionally unbalanced. Meatloaf may be your favorite, but eating it three times a week will burn anyone out. By planning your meals in advance you can look up new recipes, try out new foods, and have more fun with your cooking. It is no fun to dig through a cookbook when you are tired and hungry, so save yourself the trouble and plan ahead. It’s a question we ask ourselves when something major goes wrong with our computer — “Should I fix it, or just replace it altogether?” Purchasing a new computer is a fairly large expense, right up there with purchasing a flat screen TV or an appliance. Usually, we’ve stored all our irreplaceable pictures, documents, music and videos on the PC as well, now inaccessible due to something as simple as a cracked screen or a broken laptop power jack.

It’s a question we ask ourselves when something major goes wrong with our computer — “Should I fix it, or just replace it altogether?” Purchasing a new computer is a fairly large expense, right up there with purchasing a flat screen TV or an appliance. Usually, we’ve stored all our irreplaceable pictures, documents, music and videos on the PC as well, now inaccessible due to something as simple as a cracked screen or a broken laptop power jack. 1. List Everything You Need to Purchase

1. List Everything You Need to Purchase We just paid for our first delivery of 100 gallons of heating oil, to the tune of $379. It is a temporary expense, since we hope to convert our 26 year old oil furnace to a gas burning one some time in the near future. Natural gas is probably the cheapest heat source in the US currently with all the shale explorations happening in the Midwest right now. Paying a lump sum like that got me thinking of ways to stretch those 100 gallons of oil to their maximum heating potential. Listed below are the heat and energy saving tips you can use to learn how to save money on heating your home.

We just paid for our first delivery of 100 gallons of heating oil, to the tune of $379. It is a temporary expense, since we hope to convert our 26 year old oil furnace to a gas burning one some time in the near future. Natural gas is probably the cheapest heat source in the US currently with all the shale explorations happening in the Midwest right now. Paying a lump sum like that got me thinking of ways to stretch those 100 gallons of oil to their maximum heating potential. Listed below are the heat and energy saving tips you can use to learn how to save money on heating your home. We all have that friend. The one who turns every conversation about debt into a sob story. They can’t stop talking about their awful credit card debt and horrible student loans. Meanwhile, they’re burning through credit card-financed chai lattes at an alarming rate and always seem to have new designer clothes.

We all have that friend. The one who turns every conversation about debt into a sob story. They can’t stop talking about their awful credit card debt and horrible student loans. Meanwhile, they’re burning through credit card-financed chai lattes at an alarming rate and always seem to have new designer clothes.