In this article we are going to explore how to start building credit from zero, nada, nothing. In other words, you’ve never applied for a credit card and your credit history is simply a blank slate. We’ll also talk about how to stay out of the credit card woes that plague all too many people. But first a history lesson.

History of Credit and Credit Cards

As far back in ancient history as we can peer, people have borrowed money from one other. Often, interest was charged as an incentive for folks with a little stash of cash to lend it out to others. When the amount was re-payed it included the accrued interest charges based on the interest rate and how long the amount had been loaned for. Some of the most common issuers of short term loans in recent times would have been banks and department stores.

Then in 1966, Bank of America invented the first general purpose credit cards for consumers to be able to buy just about anything on revolving short term credit. Bank of America’s card would later be franchised under the name Visa and is now one of the most recognized names in the credit card industry.

This is the extremely abbreviated version of credit card history. If you are interested in the long version, you can read the excellent article, History of Credit Cards at CreditCards.com.

Risks of Using a Credit Card

Credit is the mojo that runs both business and consumer finances in the developed world. As a consumer, if you don’t have credit, finding a place to rent or even signing up for a cell phone plan will be difficult. However, credit in the form of credit cards can be either a tool or a master. As a friend of mine once said, “Master Card is either a master tool, or the master in charge.”

Here are a few of the risks in credit card use:

- Using credit cards opens the door to the possibility of credit card fraud and the threat of identity theft

- The use of credit cards can become addictive. Can’t afford that product you simply have to have? Just charge it!

- The process of swiping a credit card works the same way whether you’re paying four dollars or 400 dollars. This makes it easier to spend large sums of cash without thinking about the impact it will have on your budget and overall financial goals. For this reason, personal finance guru Dave Ramsey among others, suggest you use the ‘envelope method‘ to keep better track of your budget and finances.

Once you understand the risks, you can take steps to avoid them. You can then start building credit wisely over time and with a carefully laid out plan in place. Good credit is a form of wealth and this asset will serve you well throughout your life.

How to Start Building Credit – 5 Easy Steps

[adsense]

1. Check Your Credit Score

FICO stands for Fair Isaac and Company one of the first credit score companies founded by an engineer and mathemetician in the 1950’s (yes, I’m a history buff). 🙂 This credit scoring system is now used by 90% of all credit card companies, banks and loan institutions to determine the loan and rate eligibility of individuals and businesses.

The three major credit reporting agencies (Equifax, TransUnion and Experian) are required by law to give you one free credit report per year. You can get your annual free credit report at AnnualCreditReport.com.

A credit report, however, is different from a credit score. You can jump through all kinds of hoops to get your actual FICO credit score from one of the 3 credit reporting agencies. Or, you can get a pretty accurate ‘TransRisk Score’ for free by signing up for an account at Credit Karma. I’ve used them for well over a year and, at this point, highly recommend them.

2. Decide How You’ll Start Building Credit

There are a number of options to start building credit from scratch.

Piggy-back on the Good Credit of Someone You Know

Maybe a parent, spouse or close friend will be happy to add you to their account. This is how my wife started building her credit. I simply added her to one of my credit card accounts and shortly after, she was able to sign up for a credit card in just her name.

Get a Credit Card from Your Local Bank or Credit Union

They will often be quicker to issue you a credit card than one of the large credit card companies, since they know you and can often see an established history of your spending and payment habits.

Sign Up for a Store Credit Card

In general, store credit cards are not a good deal. However, this can sometimes be the wedge in the door that you need to start building credit.

Apply for a ‘Starter Credit Card’

This is how I got my first credit card. Capital One was signing up folks with no credit history (i.e. students) and giving them a ‘starter’ credit line of $500. I signed up and the rest is history. By the way, I still keep this first card open. It’s good for my overall score as you’ll see in the rules of credit card use listed below.

As a Last Resort, Get a Secured Credit Card

This is the last option you want to choose since it comes with extra risk and possible fees. Basically you dedicate an amount of money in a bank account to be ‘collateral’ for the credit card. Should you fail to make a payment, the bank issuing the credit card can withdraw the funds from this account to cover the card payment. Just make sure the secured card you sign up for reports back to the credit reporting agencies.

3. Follow the Rules of Credit Card Use

- Always pay off your credit card(s) in full every month

- Avoid making purchases that are more than 10% of your total credit line (example: on a $500 line of credit keep purchases under $50)

- Never spend more on your credit card than you know you’ll be able to pay off this month

- Track your spending using a free online service such as Mint.com

- If you find yourself using your credit card too freely on unplanned purchases, leave it at home or take it a step further and lock it up in a block of ice. By the time the ice thaws, you’ll have thought through your purchasing decision a little better.

4. Avoid Applying for Too Many Cards

Your credit score is based on a number of variables including how many lines of credit you have open. So, having too many credit cards can be seen as risky and will lower your overall score. Also, the length of time your lines of credit have been open affect your score as well. Keeping your first credit card and using it every once in awhile is a good way to maintain that high score you’ve worked hard to build.

5. Start Building Credit by Using Your Credit Card Regularly

Using your card regularly and paying it off each month will establish your reputation as a low risk borrower. Then, when it comes time to borrow a large sum of money (a home mortgage for example), you’ll be approved quicker and get the best rates available for your credit score bracket.

Perks of Building Credit

I should add that most credit cards have additional perks besides convenience that can make them worthwhile to use.

These include:

- cash back, usually on specific spending categories that rotate quarterly

- air miles or other air travel related perks

- free additions to purchased services (example: free roadside assistance for a rental car)

If you follow these five steps to building credit from scratch, your credit score is pretty much guaranteed to climb.

In conclusion, here are a few questions for you readers:

- Do you track your credit score?

- What additional methods have you used to build your credit score?

- With all the inherent risks in credit card use, are credit cards worth it?

Feel free to sound off in the comments below.

There are many approaches to ensure that you save electricity, reduce your electricity bills, and ultimately save some cash. Besides small additions such as power strips which enable you to easily switch off a group of electronic appliances in the home, there are various reasons why you should invest in an Energy monitor. An energy monitor affords you the opportunity to monitor the total amount of electrical energy that you are consuming at home.

There are many approaches to ensure that you save electricity, reduce your electricity bills, and ultimately save some cash. Besides small additions such as power strips which enable you to easily switch off a group of electronic appliances in the home, there are various reasons why you should invest in an Energy monitor. An energy monitor affords you the opportunity to monitor the total amount of electrical energy that you are consuming at home.

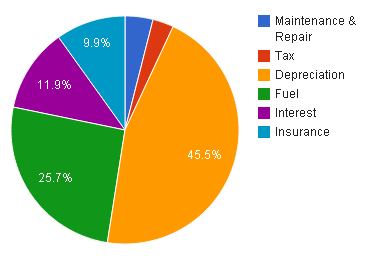

Consumer Reports used data from over 300 vehicle owners to come up with the data for the pie chart on the right. The average purchase price for a new car in the US this year is $30,000. Most people don’t have $30,000 dollars to plunk down on a new automobile, so they finance it. Financing an item that depreciates several thousand dollars as soon as you drive it off the lot seems like a bad financial decision to me. If you look at the chart, you’ll see that the combined costs of vehicle financing and depreciation is over 50% of the total cost of car ownership!

Consumer Reports used data from over 300 vehicle owners to come up with the data for the pie chart on the right. The average purchase price for a new car in the US this year is $30,000. Most people don’t have $30,000 dollars to plunk down on a new automobile, so they finance it. Financing an item that depreciates several thousand dollars as soon as you drive it off the lot seems like a bad financial decision to me. If you look at the chart, you’ll see that the combined costs of vehicle financing and depreciation is over 50% of the total cost of car ownership! In the spirit of yesterday’s

In the spirit of yesterday’s