Some of us are still feeling the pinch of a lingering recession, with 2012 proving to be a financially challenging year. This is a good reason to think of creative ways to make our money stretch a little further each month.

The good news is there is a multitude of fun, free activities for you to enjoy this summer.

Here are ten of the best:

1. Make a camp in the garden

1. Make a camp in the garden

Your kids will love this. It’s just like taking a holiday, but you get to use your own bathroom! Put up your family tent (if it fits in your garden) and set up the camp stove to make proper camp food – anything with sausages!

Older kids might be trustworthy enough to sleep in it alone, and you could allow them to invite some friends for a sleepover. Not only will they love this slice of independence, you wont hear them giggling at 2am!

Younger kids will enjoy sleeping out there with you. Join your sleeping bags together and tell each other funny stories to make it a night to remember.

2. Mug up on your art

Most art galleries offer free tours and workshops on particular days. Or you could visit an auction house, the majority of which offer free entry to pre-auction exhibits. There is usually a wide variety of featured artwork on show, from graffiti to fine art.

3. Swap your old books

If you have shelves full of books that you’ve already read (or given up on) now might be a good time to swap them for someone else’s collection.

There are several websites that allow you to do just this, such as paperback swap, where you can list your books, send them off, and then search for new books to spend your credit on. You can also sell your books on Amazon and use the proceeds to buy others you’ve been hankering to read.

4. House Sitting/Home Swap

How do you fancy taking a break for free? House sitting may not pay well, but in return for free accommodation and a tax-free food allowance, you must agree to feed pets, water plants and agree to not leave the house for more than a few hours at a time.

House swaps offer you the chance to swap homes with people in far-flung locations.

5. Review a new restaurant

Mystery shopping is now a $1.6 billion dollar industry, focused on improving the customer service offered by retail outlets, restaurants and service providers.

During an assignment you should expect to be asked to eat anywhere, from fine dining restaurants to fast food outlets, for a set budget of somewhere between $10-$90.

6. Sign up with a reward and cash-back site

To use a rewards site, you simply click through the company you plan to purchase from via a reward cash back site, and you get paid for doing so.

There are several reward sites offering this service, including Ebates, Fat Wallet, and Rewardit. You have to become a member to take advantage, but once signed up, you simply log in, find the retailer of your choice, and click the link on the cash back site in order to be directed to that retailer.

Once you have bought something, you earn cash back with Rewardit for example, which you can withdraw from your cash-back account as soon as you have reached a specified target.

7. Make a meal of weeds

This may not be for the faint of heart. However, foraging for food can be fun and free, and opens culinary doors you might not have tried otherwise. Rosehip can be made into a delicious syrup or tea and contain as much vitamin C as an orange. Dandelions can be used in salads or the leaves sautéed as an unusual side dish.

8. Theme a Week

Pick a theme and dedicate an entire week to it. This summer my family and I are planning an ‘Olympic week’ during which we will be hosting our own Olympic games (sack race, relays, shot-put), going to the library to research Olympic history, making our own sporty outfits, and eating different foods from around the world.

The choices are endless and your family will have bundles of fun as well as learning along the way.

9. Get a free haircut

If you’re not quite brave enough for a DIY haircut, trainee hairdressers and barbers need to practice their fledgling skills on someone, and that someone could be you! Hairdressing academies give people the chance to get their hair cut and styled for free, under the watchful eye of an experienced professional, of course. Your mileage may vary.

It may take a little longer, but you’re not paying for the privilege, so you may as well put on your iPod, and enjoy it!

10. Take a dog for a walk

Owning a dog takes time, money, space and a great deal of responsibility. But, the rewards are priceless – dog owners are reportedly happier and healthier than us canine deficient individuals.

If you like the idea of dog walking but without the stress, why not advertise your dog walking services in local stores or papers.

Editors Note: This article was written by Kathryn Thompson. Kathryn is an experienced blogger and mom to three daughters aged 12, 10 and 5. Kathryn enjoys earning while she spends using Rewardit – the cashback and reward site.

As you can see, we aren’t into blogging to get rich. It’s a great hobby where we exercise our writing skills, hopefully help a few people out, and generate a little side cash along the way. We are also in the process of exploring additional revenue streams that include the eBay Partner Network, Commission Junction Affiliates, and the ClickBank referral program.

As you can see, we aren’t into blogging to get rich. It’s a great hobby where we exercise our writing skills, hopefully help a few people out, and generate a little side cash along the way. We are also in the process of exploring additional revenue streams that include the eBay Partner Network, Commission Junction Affiliates, and the ClickBank referral program. Articles about

Articles about  What is the Pennsylvania Homestead Tax Relief Act?

What is the Pennsylvania Homestead Tax Relief Act?

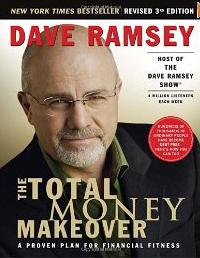

2. Read or Listen to Books on Personal Finance

2. Read or Listen to Books on Personal Finance

1. Rock Painting

1. Rock Painting 4. Chalking

4. Chalking

Recurring Costs (aka budget items)

Recurring Costs (aka budget items) 1. Make a camp in the garden

1. Make a camp in the garden

Now, on to some of our favorite articles from the blogosphere this past week:

Now, on to some of our favorite articles from the blogosphere this past week: